Multi-factor authentication

Added security for your Datatrans user account.

Reports about user data stolen over the web or hacked accounts have become a regular fixture in the media. Users’ login credentials are intercepted again and again for the purpose of electronic break-ins (phishing).

To minimise the risk and offer additional security for your Datatrans user account, Datatrans now offers its customers multi-factor authentication (MFA).

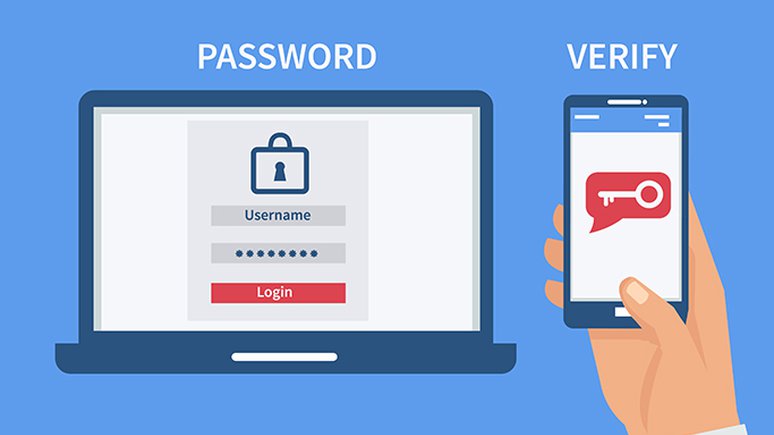

MFA requires two or more separate forms of verification (factors) for logins. This additional barrier also protects your user data even after an instance of theft.

There are three types of factors:

- Knowledge: the user knows their username and password.

- Ownership: the user has a physical element (token) in their possession, such as a credit card or mobile phone.

- Biometrics: a person’s physical characteristics such as a fingerprint.

ATMs offer a classic example of multi-factor authentication. You insert your bank card (ownership factor) into the machine and enter your PIN code (knowledge factor).

It works in much the same way when you log into a user account: you first enter your user details (login/username/password – knowledge factor). The second step is to verify the login with a verification code that is generated by an authentication app on your smartphone (ownership factor). Datatrans supports the smartphone apps Google Authenticator (Apple App Store, Google Play Store) and Authy (Apple App Store, Google Play Store).

Activation

Multi-factor authentication can be activated in the user settings and is optional.

Detailed instructions on multi-factor authentication can be found in the user guide provided by Datatrans Backoffice (Web Administration Tool).