Authorisation process

The parties involved in online commerce

Merchant

You, the provider of goods or services in your online shop

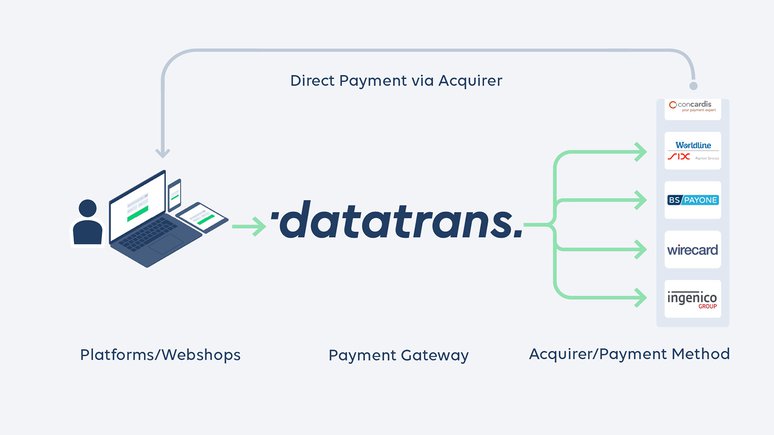

Payment Service Provider (PSP)

Technical point of intersection between your online shop and the acquirers (payment method), e.g. Datatrans.

Processing contract required.

Acquirer/financial institution

The merchant’s contractual partner enters acceptance contracts with you that allow you to accept online payment methods and is responsible for the cash flow between you and the card holder, e.g. BS PAYONE, Concardis, PayPal, PostFinance, SIX, Swisscard.

Acceptance contract required

3-D Secure E-Commerce (customer initiates payment) or order-by-mail/phone (merchant initiates payment).

Important: no liability shift with order-by-mail/phone transactions, i.e. more risk.

Issuer/card-issuing bank

Contractual partner of the card holder.

Card holder

Buyer, your customer

What do you need in order to accept online payments?

- An online shop

- Acceptance contracts with acquirers/financial institutions (for the payment methods)

- A processing contract with Datatrans

- Integration into the Datatrans system

Process

- The merchant displays the Datatrans payment page to the customer.

- The customer selects his preferred payment method and confirms the transaction with the relevant credentials (card number, PayPal login, etc.).

- Datatrans sends the transaction to the acquirer. For credit cards, a 3D-Secure authorization is usually carried out.

- The acquirer sends the status to Datatrans.

- Datatrans returns the status of the transaction to the merchant. The customer is simultaneously redirected to the response page (accepted or declined).