Optimising conversions made easy.

PSD2 has introduced obligations for Strong Customer Authentication (SCA) – but it is not always mandatory: with Datatrans, you can integrate 3-D Secure into all of our checkout solutions and minimise the number of SCA processes effortlessly.

Three paths to a frictionless payment experience.

Since January 2021, the new Payment Services Directive (PSD2) has made the Strong Customer Authentication (SCA) of online card payments mandatory within the European Economic Area. The introduction of the 3-D Secure process to accomplish this makes payment processes more secure, but added more complexity.

Datatrans offers three solutions to help you meet your obligations without adding more steps to the payment process wherever possible and therefore improve your conversion rate. All of the solutions are certified compliant with 3-D Secure 2 and thanks to our ongoing technical development process, you will always be at the cutting edge.

For detailed information on all solutions please see our guide.

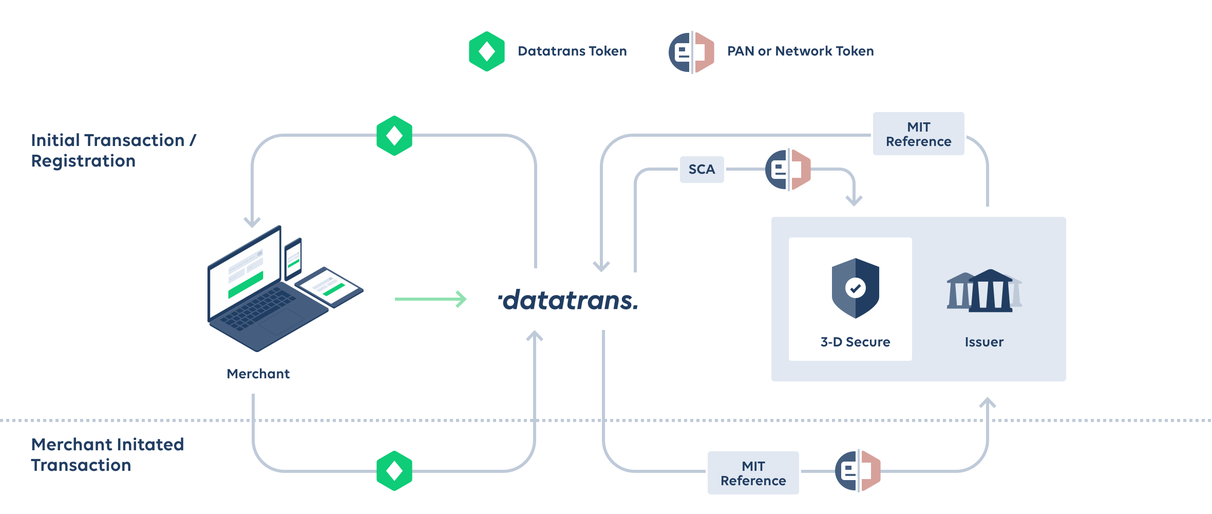

Merchant-initiated transactions.

Transactions such as the collection of subscription fees, variable electricity bills and other merchant-initiated transactions (MIT) are not subject to the new Payment Services Directive. They can therefore continue to be processed without SCA.

Once the customer has been authenticated through 3-D Secure during registration or the first transaction, you store their card details as a token. The Datatrans Payment Gateway then automatically recognises subsequent MIT payments and flags them accordingly to ensure a smooth approval process from the issuer.

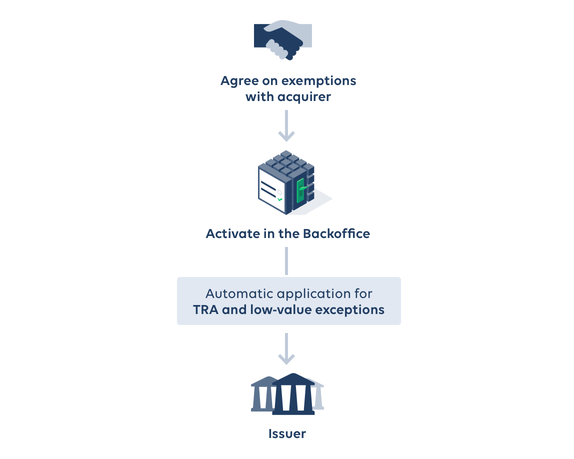

Easy payments with SCA exemptions.

In order to provide their customers with a convenient shopping experience, issuers frequently grant PSD2 exemptions to allow payments without strong authentication. In addition, card issuers give merchants the option to request your own exemptions, provided that your acquirer agrees with them.

Two clicks are all it takes...

The corresponding exemption options for low risk transactions (Transaction Risk Analysis or TRA) or low value transactions (LVA) are easily activated in the Datatrans Payment Backoffice.

…for everything to work automatically.

The Datatrans Payment Gateway takes care of submitting the request to issuers and only takes your customers through the SCA process if the card issuer declines an exemption.

See our documentation for further details.

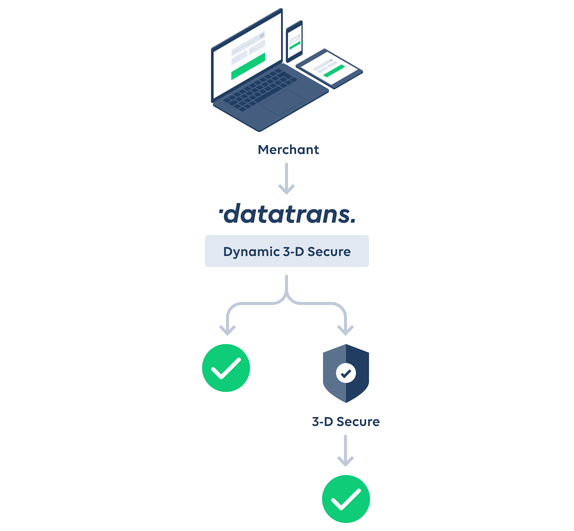

Dynamic 3-D Secure.

Do you sell to markets both inside and outside the EU and do you want to allow as many of your non-EU customers as possible to pay without authentication?

Using «Dynamic 3-D Secure» the Datatrans Payment Gateway only routes those transactions through the SCA where it is mandatory.

Once the function has been enabled, the system checks whether the card was issued in an EU country and takes your customer through the check-out process accordingly. In addition, the Payment Gateway automatically responds to «soft declines», which issuers use to provisionally reject payments and request strong authentication.

Thanks to the dynamic processing, you benefit from a high proportion of transactions that do not involve any extra steps while remaining PSD2-compliant at all times.