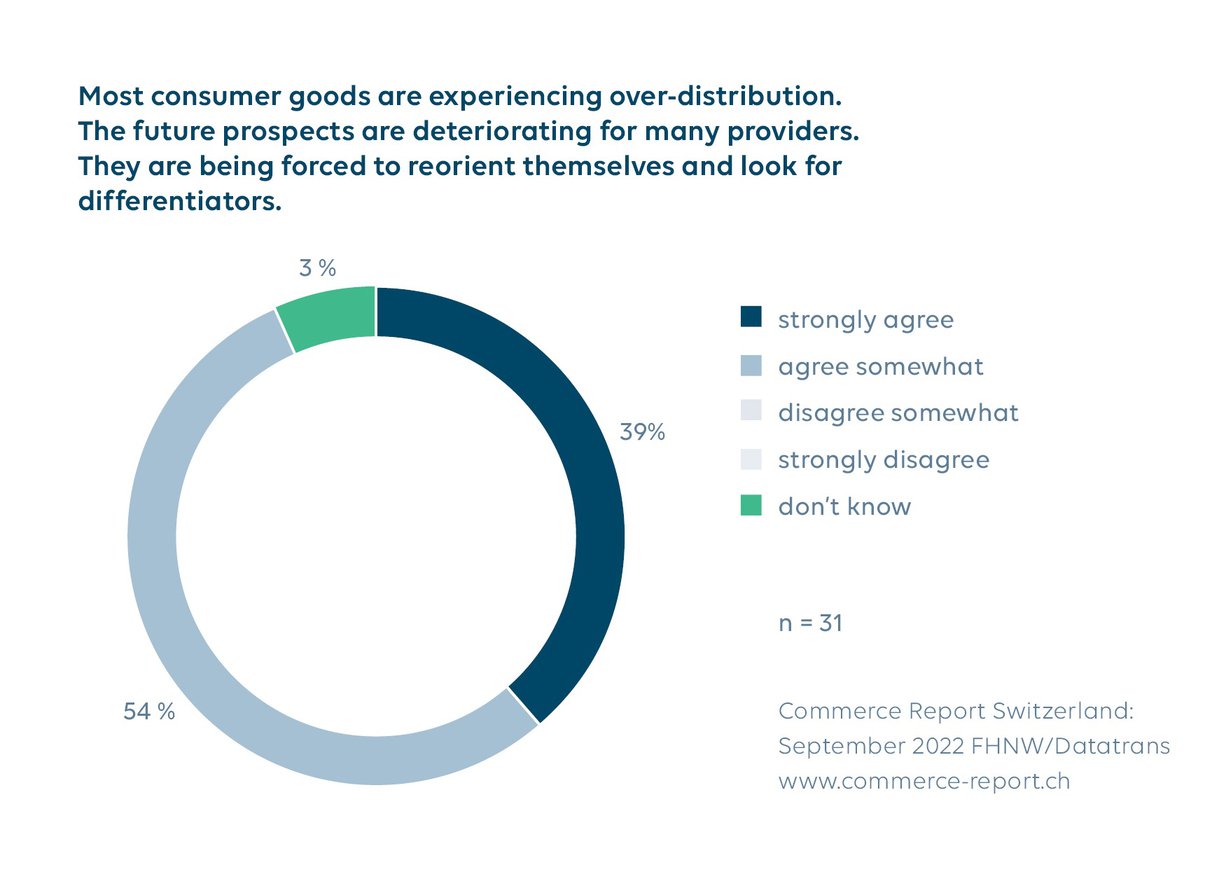

Massive oversupply of purchase options forces retailers to rethink.

Datatrans from Planet and the University of Applied Sciences Northwestern Switzerland present the 15th Commerce Report Switzerland.

Zurich, 22 September 2022

Coronavirus has triggered a new era in retail. Buyers have discovered the variety of what online shopping has to offer. Providers followed suit with increasingly more investments. The undesired side effect: too many ways to buy the same products. Providers are now desperately looking for ways to differentiate themselves. Customers' increased value orientation and a high level of openness to services represent connecting points. Overall, online retail expects that sales are set to increase by 50 percent by 2030.

«Having 25 brick-and-mortar stores with the same range spread across Switzerland makes sense. But 25 identical online shops simply does not. If the same product is available for sale in too many places, then everything comes down to price,» says the head of the study Prof. Ralf Wölfle, in summing up his survey results. «However, only the largest providers can keep up with the price. That’s why retailers want to create attractive added value for their customers which goes beyond the replaceable product.»

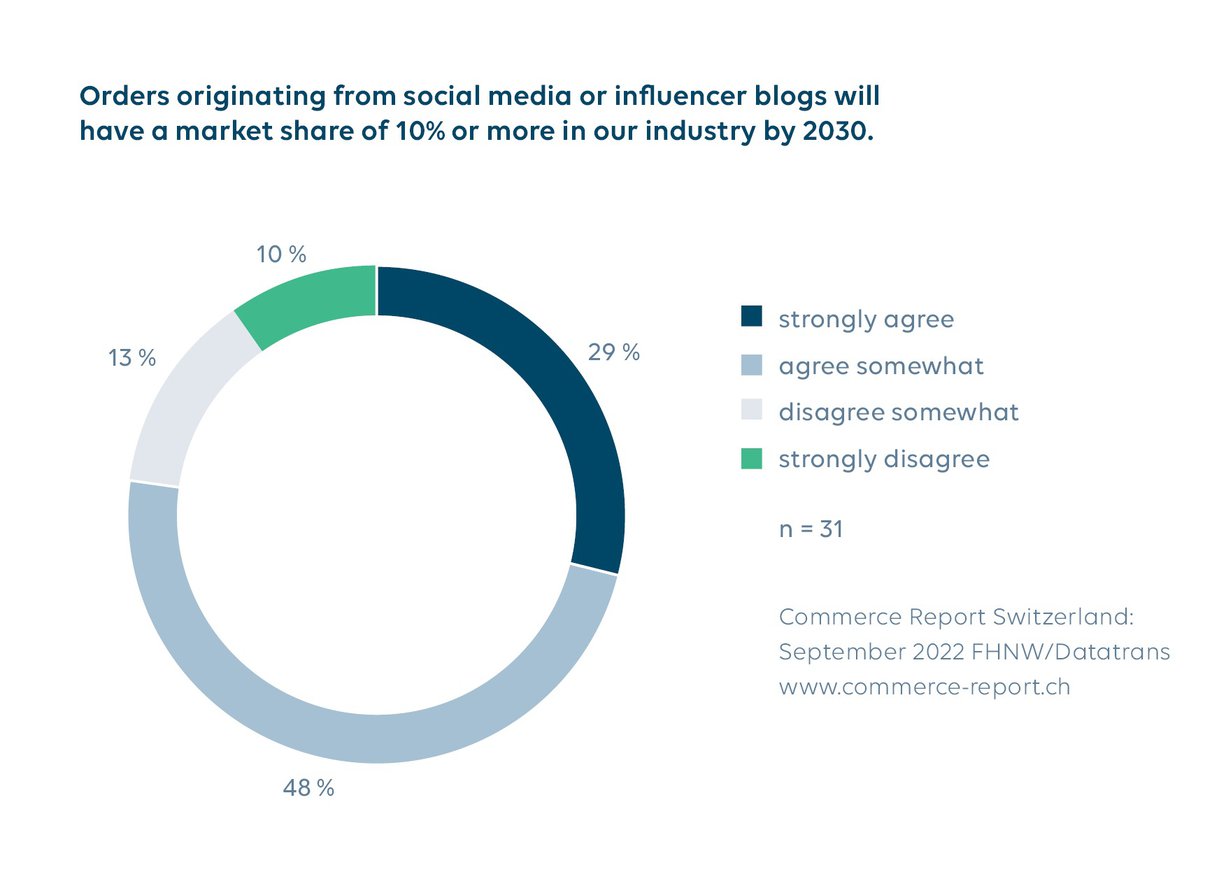

Increasing variety of offers through social media as well

By differentiating itself through values and services, the retail sector is expected to further increase the variety of its product ranges. Direct sales from brands to end customers as well as increasing sales via social media channels play into this trend. Compared with conventional online marketplaces, social media is becoming increasingly important as it is easier to convey value-oriented offers.

High service readiness in quick commerce

Online delivery services score points with a high level of service readiness. They benefit from the fact that nearly half of all supermarket purchases are unplanned. If they unexpectedly forget something, customers do not want to hurry to the store again, and instead just want the products delivered to them. With the fastest Zurich provider, this can be done in under 15 minutes. Testing by various supermarket chains to deliver directly from the store are also an example of new segments emerging in food e-commerce.

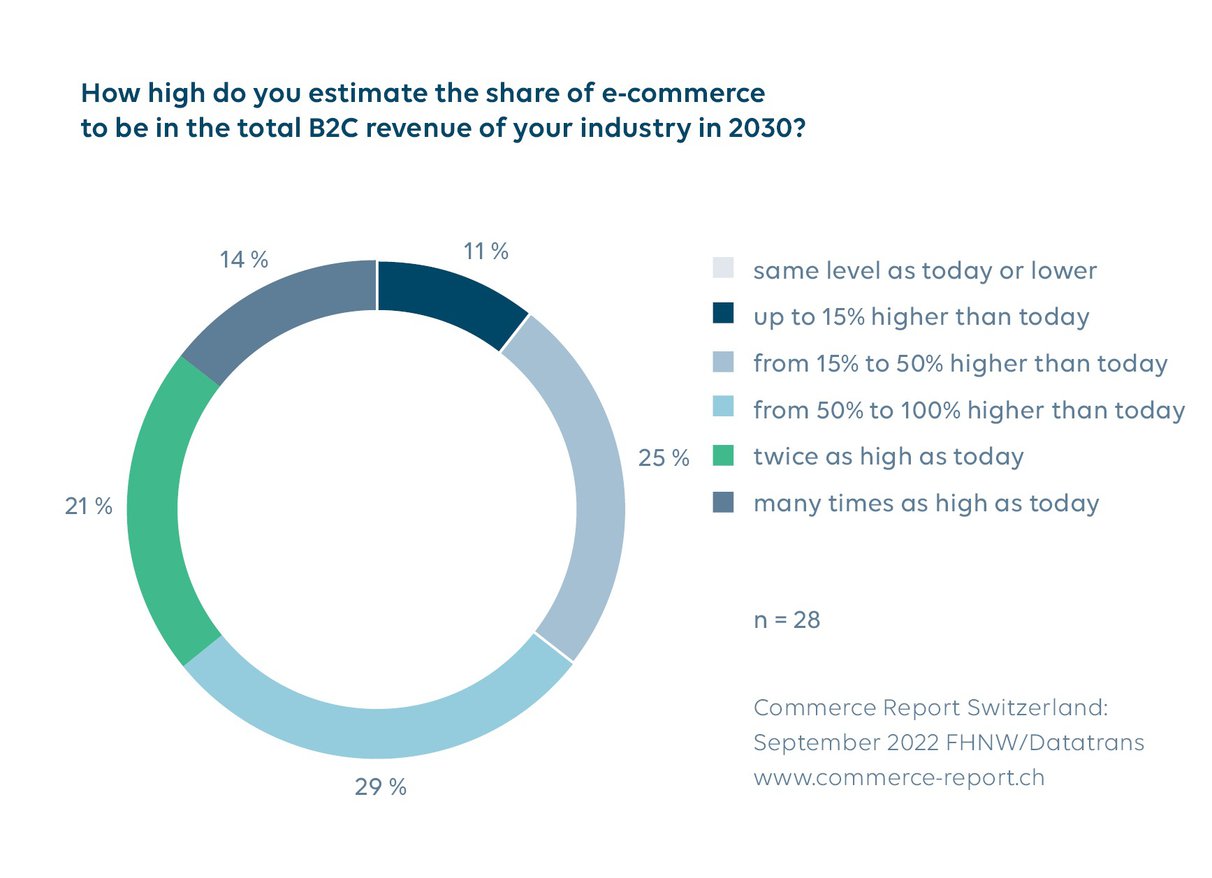

E-commerce sales are set to grow by 50 percent

Despite the rediscovery of brick-and-mortar retail after coronavirus, online growth continues unabated according to the study participants: two-thirds expect e-commerce sales in their industry to increase by 50 percent or more by 2030. From the perspective of the participants, the trends that will have the greatest impact on the industry in the years to come are sustainability and upheavals in logistics.

Retailers and brands in a relationship crisis

What brands and retailers are currently dealing with is a slowly emerging conflict: ever since stores were closed due to lockdowns, established brands have been driving their direct sales to end consumers. Retailers are increasingly competing with their suppliers. Meanwhile, brands are complaining that retailers are not representing them well enough and that they are not receiving enough data on customer behaviour. The positions have become entrenched – even if retailers and brands will still need each other in the future.

–––

About the Commerce Report Switzerland

Since 2009, the Commerce Report Switzerland has been investigating the importance, changes, and trends in sales to end consumers – as the only series of studies from the perspective of providers. Participants are being interviewed by the University of Applied Sciences and Arts Northwestern Switzerland (FHNW). The study has been commissioned by Datatrans from Planet.

Selected topics

- More flexible forms of work are giving rise to more diverse purchasing needs

- Options for differentiation in the face of increasing competition

- Increasing expectations of sustainability and value orientation

- Seven paradigms of successful providers in Connected Commerce

- Outlook for 2030 and classification of the most important trends

Participants

This year’s qualitative survey included 32 market-defining Swiss online and multichannel providers such as Brack, Pfister, ON, Ricardo, Migros, Coop and Aldi. The participating companies generated an e-commerce volume of around CHF 3.1 billion.

Free download

www.commerce-report.ch/en/current-study/

More information

www.commerce-report.ch

About Datatrans from Planet

Datatrans is the market leader in Switzerland for tailor-made e-commerce payment solutions for online shops and mobile apps. As part of Planet, a globally leading technology company, a holistic platform for Connected Commerce is being developed. By merging software, payment solutions, and technology, companies are expected to tap into the benefits of the increasingly connected world to create attractive recurring shopping experiences for their customers. More information at www.weareplanet.com.

Contact

Prof. Ralf Wölfle, Study Director, University of Applied Sciences and Arts Northwestern Switzerland, Head of E-Business Competence Focus

061 279 17 55, ralf.woelfle@fhnw.ch

Patrick Hagmann, Marketing & Project Manager, Datatrans from Planet

044 256 81 91, marketing@datatrans.ch

-

Press Release Commerce Report Switzerland 2022 (PDF)

-

Graphic 1: Over-distribution and the quest for differentiating features (JPG)

-

Graphic 2: Social media as a starting point for orders (JPG)

-

Graphic 3: Expectations of e-commerce growth by 2030 (JPG)

-

Cover image «Commerce Report Switzerland 2022» (PDF)

-

Image «Feel-good Connected Commerce» (JPG)

-

Photo of the cited Prof. Ralf Wölfe (JPG)